Who can I add to my funeral policy?

Sanlam Indie Funeral Cover allows you to add up to 20 additional family members to your policy (so that’s 21 in total, including yourself). We need to know their full names, South African ID numbers and relationship to you.

Who can I cover?

You can take out Funeral Cover for yourself if you are below 61 years old. Once you have your policy, we'll continue to cover you as you age. You can add additional lives of up to 85 years old.

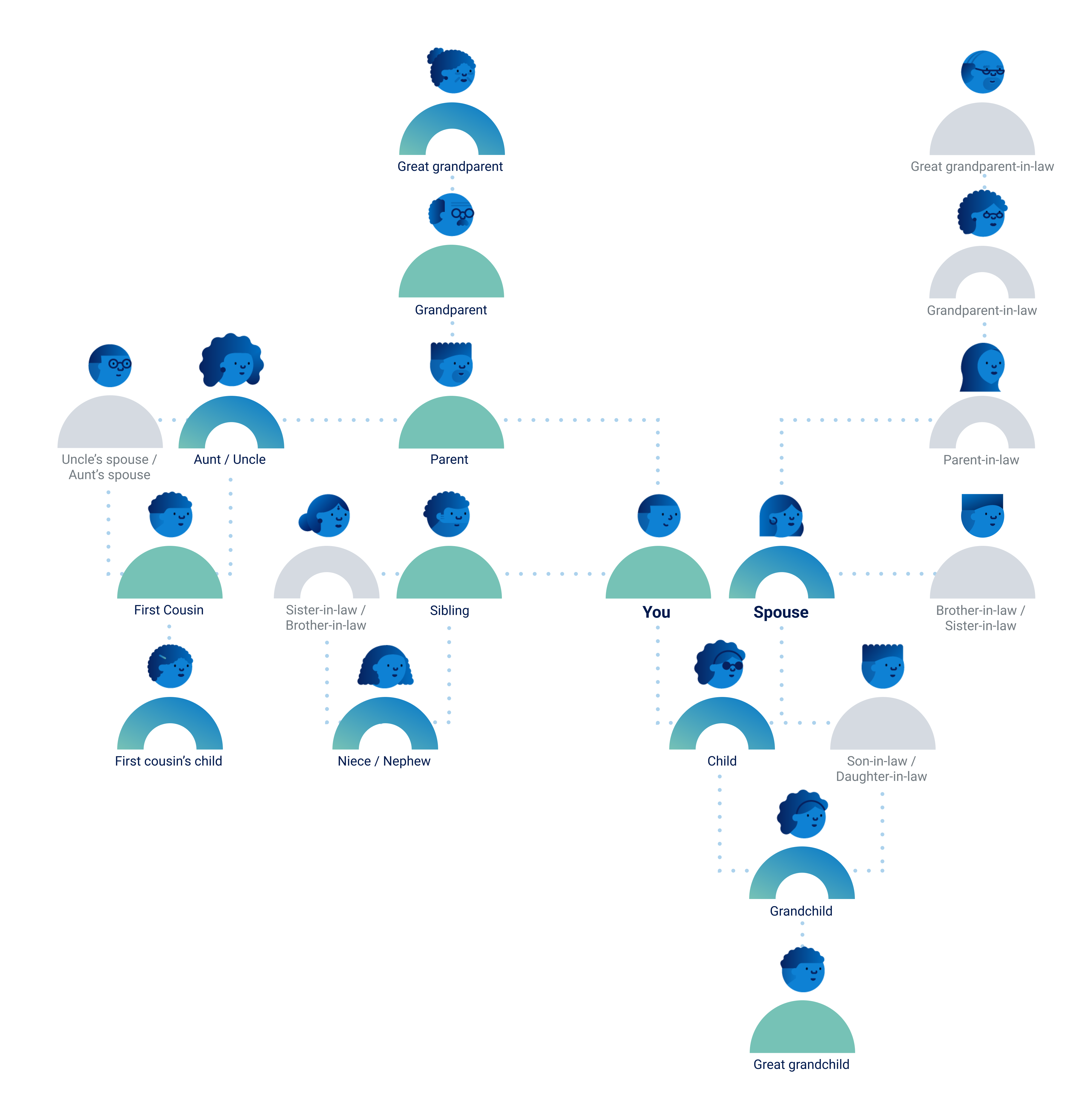

You can add your:

Spouse (husband or wife, or partner)

Child (biological or legally-adopted son or daughter, or the child of your spouse)

Parent (biological or legally-adopted mother or father)

Step-parent (mother or father’s spouse)

Parent-in-law (spouse’s parent)

Daughter-in-law (child’s wife)

Son-in-law(child’s husband)

Sister (biological, legally-adopted, or stepsister)

Brother (biological, legally-adopted, or stepbrother)

Sister-in-law (female spouse of your brother or sister, or your spouse’s sister)

Brother-in-law (male spouse of your brother or sister, or your spouse’s brother)

Niece (brother or sister’s daughter)

Nephew (brother or sister’s son)

Aunt (parent’s sister, or your uncle’s wife)

Uncle (parent’s brother, or your aunt’s spouse)

First cousin (aunt or uncle’s child)

First cousin’s child

Grandparent (grandmother or grandfather)

Grandparent-in-law (spouse’s grandparent)

Great grandparent (grandparent’s parent)

Great grandparent-in-law (spouse’s grandparent)

Grandchild (your child’s child)

Great grandchild (your grandchild’s child)

What counts as married?

Your spouse is your husband or wife by marriage. You must be married to this person already when you take out the policy.

Sanlam considers a marriage to be when 2 people are:

Married according to the laws of any sovereign country;

Married according to customary or tribal law;

Married under any religion that is practised in South Africa;

Living together and financially dependent on one another for at least 6 months; or

Party to a civil union in terms of the Civil Union Act, 2006.

I live with my boyfriend/girlfriend. Can I add them to my policy?

Yes, if you have been living together and are financially dependent on one another for at least 6 months when you take out the policy. You can add them to your policy as “spouse”.

Can I cover my spouse’s family?

You can cover your spouse’s parents and grandparents, and any children your spouse may have from another relationship.

You can cover your spouse’s siblings but you can’t cover their sibling’s family. Your spouse would need to take out a new policy, in their own name, to cover their siblings and their sibling’s families.

What are the Funeral Cover limits?

When you take out a policy, your cover limits are as follows:

Children and adults aged 15-85 years: R50,000 each

Children aged 7-14 years: R25,000 each

Children aged 0-6 years: R10,000 each

This cover doubles after 3 years at no extra cost to you. So, after 36 months your cover could be:

Children and adults aged 15-85 years: R100,000 each

Children aged 7-14 years: R50,000 each

Children aged 0-6 years: R20,000 each

The minimum cover amount for each added family member is R1,000.

Can I just get cover for my family and not myself?

We don’t offer Funeral Cover on other lives unless the policyholder (that’s you) also insures their own life in some way.

We're on a mission.

At Sanlam Indie, we're using cutting-edge technology to transform the industry and deliver financial services that actually work for you.

No jargon. No messy paperwork. Just world-class products that are simple to use, easy to understand, and incredibly rewarding - allowing more ways for you to create and protect wealth.

Copyright © Sanlam Indie 2022. All Rights Reserved. Sanlam Indie's product offering is underwritten by Sanlam Life Insurance Limited, a licensed life insurer & financial services provider. Sanlam Indie is a division of Sanlam Life Insurance Limited - Reg No. 1998/021121/06. Sanlam Life Insurance Limited is an authorised FSP (No. 2759). Address: 1st Floor Glacier Place, 1 Sportica Crescent, Tygervalley, Cape Town, 7530

Privacy | Terms of Use | Promotion of Access to Information Act